Trump's decision to place sanctions on any country buying Venezuela's oil has sparked some bullishness in oil markets this week.

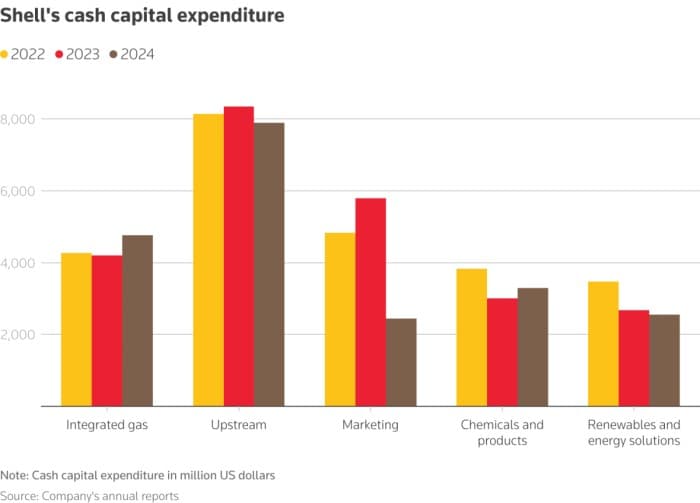

- As London-based energy major Shell (LON:SHEL) issued its 2024 annual report ahead of this year’s Annual General Meeting, its general pivot back to fossil energy set the stage for other companies to follow suit.

- In line with higher shareholder returns in the US, Shell hiked its distribution target to 40-50% of operations cash flow, up from the current 30%-40% range, whilst also trimming its investment budget by $2-3 billion to a $20-22 billion through 2028.

- Pledging to maintain ‘material’ oil production beyond 2030, sustaining output around the current level of 1.4 million b/d, Shell will seek to maximize gas production, aiming for 4-5% annual increases in LNG sales in the 2026-2030 period.

- It seems that the new benchmark for low-carbon investment amongst oil majors will be around 10% of capital employed, well below Shell’s 2022 peak of allocating a third of their total capital expenditure on renewables.

Market Movers

- UK oil major BP (NYSE:BP) has agreed to sell its 25% stake in the Trans-Anatolian Pipeline that carries Azerbaijani gas through Turkey to US asset management firm Apollo (NYSE:APO) for $1 billion.

- London-based Africa explorer Tullow Oil (LON:TLW) agreed to sell its entire working interests in Gabon for $300 million in cash to the Gabon Oil Company, as it continues to be weighed down by debt.

- Mexico’s state oil firm Pemex is reportedly in talks with billionaire Carlos Slim to jointly operate the 800 MMbbls Zama offshore field and the country’s largest gas field Ixachi, ceding operator control in a rare move by the Mexican NOC.

Tuesday, March 25, 2025

Donald Trump has been concurrently the biggest oil bear and oil bull out there, and this week has driven bullish sentiment. U.S. sanctions on Venezuela, effectively punishing any country that is buying PDVSA barrels except for refiners in the United States, coincided with a one-month extension of Chevron’s mandate to wind down operations in the country. With market participants wary of less heavy oil in the market, ICE Brent futures jumped above $73 per barrel again.

Trump Slams Tariffs on Buyers of Venezuelan Oil. The White House introduced a 25% tariff for any country that buys oil or gas from Venezuela in case of any trades made with the United States, impacting China as the Asian nation accounted for 55% of Venezuela’s 500,000 b/d exports lately.

US Mulls Taking Over Ukraine’s Nuclear Plants. US Energy Secretary Chris Wright stated that American companies could operate Ukraine’s power plants ‘with very little problem’, arguing that such an arrangement would be the best protection of the country’s energy infrastructure.

Russia-Ukraine Ceasefire to Include Revived Grain Deal. As Russian and US officials met in Saudi Arabia to discuss a potential ceasefire in Ukraine, the Black Sea grain deal could see a revival after the initiative ended in 2023, potentially bringing more Ukrainian agricultural exports to the market.

Iraq Accuses Iran of Forging Documents. Iraq’s oil minister Hayan Abdul Ghani alleged that Iranian oil tankers have been using forged Iraqi shipping documents, rejecting any Iraqi implication in recently detained tankers, as Baghdad remains under US pressure to cut links with Tehran.

Weak Asian Demand Weighs on LNG Prices. The average LNG price for May delivery into Northeast Asia dipped to $13.5 per mmBtu, a three-month low and some $0.50-0.60/mmBtu higher than European delivered prices, as mild weather forecasts and weak Chinese demand cap the upside.

Trading Majors Splash the Cash on Aluminium. Global trading giants Vitol and Gunvor have been ramping up their long positions in physically deliverable LME aluminium contracts, as both the February and March contracts saw one trading entity hold at least 30% of open interest upon expiry.

OPEC+ Mulls Continuation of Output Hikes. OPEC+ countries will most probably continue raising oil output for a second consecutive month as part of the oil group gradually unwinding its production cuts, boosting global production by another 135,000 b/d after April is set to grow by 138,000 b/d.

Glencore Commits to Coal Production Cuts. As benchmark Australian Newcastle coal futures plunged to $97 per metric tonne, down 20% since the start of the year, the world’s largest coal producer Glencore (LON:GLEN) stated that it would cut output by 5-10 million tonnes in 2025.

Antimony Soars on Chinese Export Controls. Chinese antimony prices continue to skyrocket after 99.85% antimony metal started to trade at ¥250,000 per metric tonne ($35,000/mt), up 70% since early February, as Beijing’s export restrictions limited exports to a mere 20 tonnes in January and February.

Indian Refiners Rush Back to Russian Crude. Indian refiners are poised to cut back on spot tenders after offers of Russian crude have rebounded to pre-January levels and March imports are set to average 1.8 million b/d, with most deliveries taking place on non-sanctioned tankers.

Copper Bulls Keep on Loving the Tariffs. Comex copper futures surged to an all-time high of $5.20 per pound this week, further buoyed by Glencore’s mining woes in Chile, as the markets bracing for a Trump tariff impact with an unprecedented 500,000 tonnes of copper sailing now towards the US.

East Africa Eyes Exploration Boost. The East African government of Kenya is planning to auction at least 10 exploration licenses in its first oil licensing round, opening up the bidding process in September 2025, concurrent to auctions taking place this year in Uganda and Tanzania.

Tesla Sales Collapse in Europe. Sales of top US electric vehicle producer Tesla (NASDAQ:TSLA) in Europe have been 43% lower so far in 2025, commanding only 10% of the BEV market in February with total monthly sales of less than 17,000 units, losing market share to cheaper Chinese EVs.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com

- Trump: 25% Tariff On Anyone Who Buys Venezuelan Oil & Gas

- Goldman Sachs Cuts Oil Price Outlook Amid Oversupply Fears

- Iran Oil Tankers Evading Sanctions with False Iraqi Paperwork