Is India overproducing soybean? But how is that possible, given our ongoing oilseed mission to promote atmanirbharta in edible oils? Consider this: For two consecutive seasons since October 2023, soybean prices in all key mandis have trailed its minimum support price. All this when Indian soybean oil imports from countries like Brazil, Argentina, and the US continue to grow.

Is it because imports are cheaper? Surprisingly, no. A cost comparison shows that domestically produced soybean oil is significantly more affordable—by as much as Rs 21 per litre, since September 2024.

So, what justifies the increasing imports?

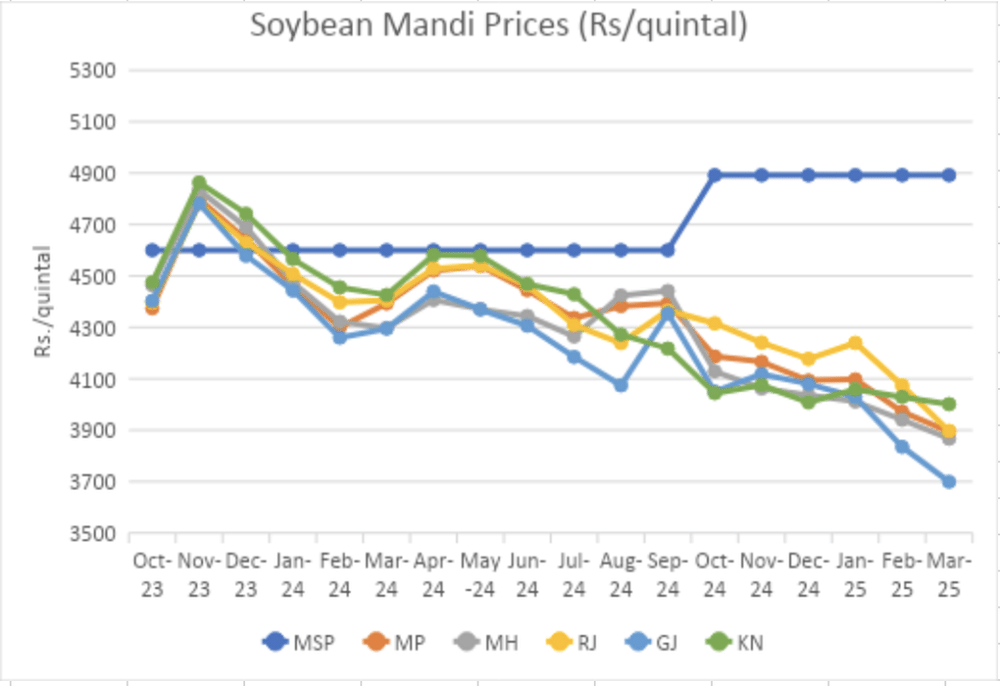

Soybean mandi prices below MSP

The current MSP for soybean stands at Rs 4,892 per quintal. However, since the start of the harvest in October 2024, mandi prices in key soybean-producing states—Madhya Pradesh, Maharashtra, and Rajasthan, which account for 90 per cent of India’s soybean production—have averaged 17 per cent below the MSP (Figure 1).

Typically, soybean mandi prices decline during the harvest months but start recovering from January/February onward. However, no such recovery has occurred this year. Five months since the new crop arrived, prices in Madhya Pradesh, Maharashtra, and Rajasthan have fallen further—by 7 per cent, 6 per cent, and 10 per cent, respectively, compared to October 2024. In fact, current prices are among the lowest recorded in the past five years.

Figure 1: State-wise soybean mandi modal price trend (Rs/quintal)

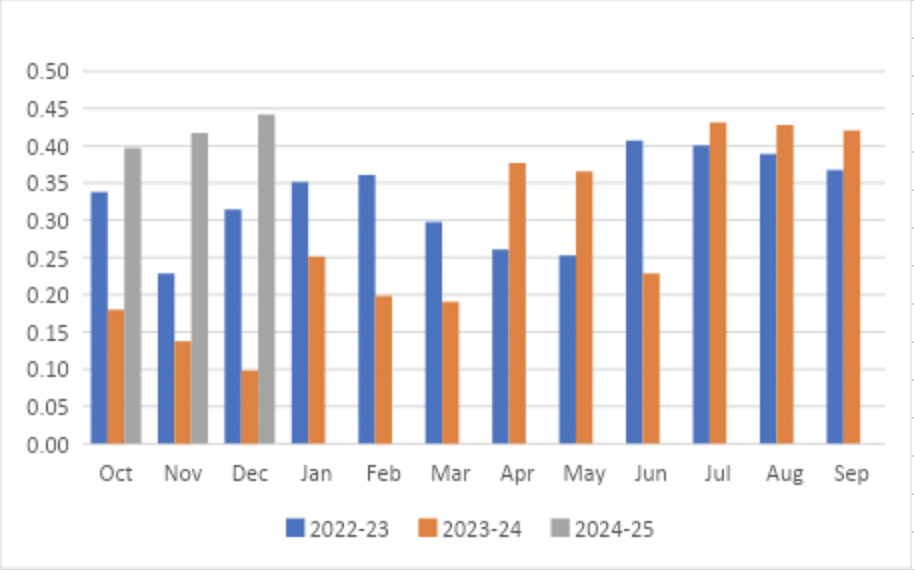

Imports of soybean oil are rising

While soybean prices remain low in India, farmers in Brazil, Argentina, and the US continue to benefit as Indian markets increasingly import their soybean oil. During the TE 2020-21 (Oct-Sep), India imported an average of 3.29 million metric tonnes (MMT) of soybean oil (both crude and refined). By TE 2023-24 (Oct-Sep), this volume had risen by 17 per cent, reaching 3.84 MMT (Figure 2).

Figure 2: Comparison of soybean oil imports over the last three years (in MMTs)

In the first three months of the current marketing year (2024-25, Oct-Dec), India’s soybean oil imports surged to a five-year high, reaching 1.25 MMT—approximately 51 per cent higher than the 0.83 MMT imported during the same period in TE 2023-24.

Also read: Palm oil cultivation is key for Atmanirbhar Bharat. It empowers farmers too

Are imports cheaper?

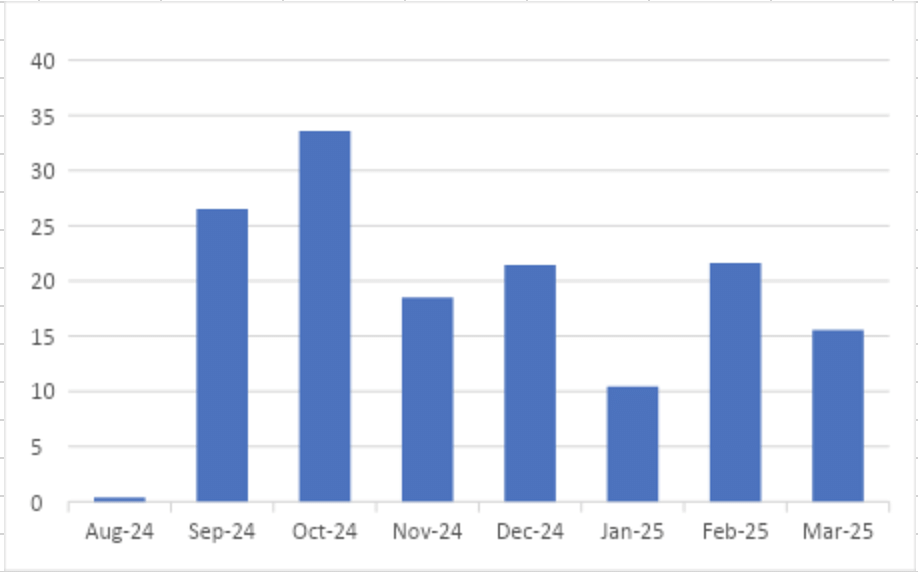

We estimated the monthly cost of producing soybean oil using both domestically sourced soybeans (priced at mandi rates from Agmarknet) and imported crude soybean oil (refined domestically). For domestic crushers, the cost was derived from soybean prices, factoring in milling charges, procurement expenses, and the value of by-products like soybean meal. For imported soybean oil, we adjusted international cost and freight (CNF) prices for import duties, landed costs, and refining expenses. Both costs were calculated at the Indore mandi level, with the price gap illustrated in Figure 3.

Figure 3: How much more expensive is imported soybean oil than the one produced domestically (Rs/litre)

As of 25 March 2025, domestic soybean oil costs about Rs 109/litre and imported soybean oil (refined in India) costs Rs 125/litre, making the domestically produced oil cheaper by Rs 16/litre. This gap was about zero in August 2024. The government increased the duties on imported crude soybean oil on 14 September 2024 from 5.5 per cent, including agri cess and social welfare cess, to 27.5 per cent.

Despite having a cost advantage, domestic soybean mandis lack buyers, as the country continues to meet its rising soybean oil demand largely through expensive imports. A similar analysis for mustard showed that without NAFED’s procurement of 2 MMT last year, mustard mandi prices too would have likely remained below the MSP.

This raises an important question: Are current production levels of these two oilseeds exceeding market demand, thus requiring intervention? Reducing production is not the solution—we need oilseed output to grow. However, these trends highlight the need for policymakers to reassess the evolving market dynamics. Structural and systemic challenges in the soybean sector require attention.

One key factor is the role of soybean oil in the overall value chain. Soybean is primarily a meal crop rather than an oil crop, as seen from both its composition (18 per cent oil and 82 per cent meal) and the revenue structure of soybean crushers, where meal contributes the majority of earnings.

When 1 tonne of soybean is crushed, 82 per cent of the output (soybean meal) is currently selling at Rs 27/kg (March 2025 prices), compared to Rs 42/kg in December 2023. Even though the remaining 18 per cent (soybean oil) is fetching about 20 per cent higher prices (Rs 118/kg in March 2025 vs Rs 138/kg in December 2023), the overall revenue per tonne of crushed soybean has declined—from Rs 55,555 in December 2023 to Rs 46,515 in March 2025. These lower margins are discouraging domestic crushers from processing soybean, leading to excess supply in the mandis.

Another critical aspect is the steep decline in soybean meal prices. Between October 2023 and March 2025, soybean meal prices fell by 37 per cent, driven by both global and domestic factors. Globally, record-high soybean production and rising closing stocks have created an oversupply. Aggressive crushing by major producers like the US and Brazil has flooded the market with soybean meal, reducing meal prices and affecting the competitiveness of Indian soybean meal exports.

Domestically, India’s about 55 MMT animal feed market—where soybean meal is a key component for poultry and cattle—has been increasingly supplied with Distillers’ Dried Grains with Solubles (DDGS), a protein-rich by-product of ethanol production. An estimated 4-5 MMT of DDGS has entered the market, offering a lower-cost alternative despite concerns over quality and aflatoxins.

With prices ranging between Rs 11-20/kg, DDGS is significantly cheaper than soybean meal, which was Rs 42/kg and has now dropped to Rs 27/kg. Contrary to expectations, DDGS is not just supplementing but displacing soybean meal in the feed sector.

With India aggressively pursuing its E20 ethanol blending mandate—aiming for 20 per cent ethanol in transport fuel—DDGS production is only expected to increase further in the coming years. This raises concerns about its growing impact on soybean meal demand and, consequently, soybean prices and farmer incomes.

This situation presents a paradox: at a time when India is striving for greater self-sufficiency in edible oils, market dynamics are pushing soybean cultivation into uncertainty.

Also read: India’s edible oil market is facing reduced demand. Increased import duty not a fix

What could be the possible solution?

Given the current trends, a decline in soybean production appears not only likely—due to persistently low prices—but also increasingly necessary to balance supply and demand. To address these challenges, it is essential to recognise the evolving edible oil consumption patterns in India.

In 1993-94, the average Indian consumed less than 1 litre of edible oil per month. In less than three decades, this has nearly doubled to 1.86 liters (2022-23). National edible oil consumption has surged from about 11 MMT in 2004-05 to approximately 25 MMT today, with most of the 13.6 MMT increase driven by soybean oil, palm oil, sunflower oil, and rice bran oil.

In contrast, groundnut oil consumption has declined, while coconut oil consumption has remained largely stable. The fastest-growing HoReCa (hotel, restaurant, and catering) segment primarily prefers palm oil due to its favorable physical properties. The impact of this shift was visible in groundnut too this year when there were limited buyers for its bumper crop. Given these shifts, oilseed production must be realigned with the changing demand for edible oils.

Improvement in soybean yields can also improve farmer economics. The MP soybean yields have plateaued at less than 1 tonne for nearly six years. They were about 1.1 to 1.2 tonnes/hectare between 2016 to 2018.

The growing presence of DDGS in the feed market poses a tangible challenge to soybean meal, at least in the near future. This necessitates a reassessment of potential markets for soybean meal beyond traditional livestock feed. Could processed soybean products such as nuggets or chunks be viable alternatives? Can new food applications be developed to expand its consumer base? The onus is on crushers and markets to innovate and drive increased domestic and global demand for soybean meal. Without such adaptations, a decline in soybean acreage may soon become an unavoidable reality.

Shweta Saini is an agriculture economist and CEO and Shruti Priya is a Research Analyst at Arcus Policy Research, New Delhi. Views are personal.

(Edited by Aamaan Alam Khan)