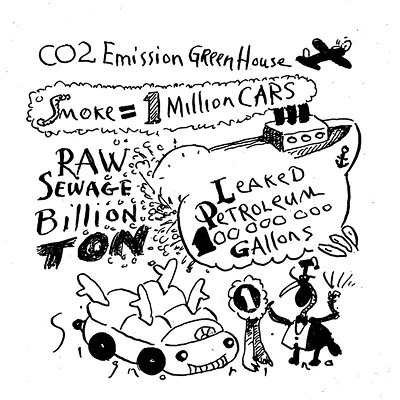

Who profits from climate change?

Now that the sea levels are rising, I’m sure someone out there is already thinking of ways of making a few quid/bucks (not that I’m interested myself, you understand). Who will profit—or indeed profiteer—from this sea change? —Chris

I SUBMIT to you, Chris, that given the various depredations of our modern era, the distinction between profiting and profiteering is, like the Louisiana coastline, rapidly eroding. In the olden days, profiteering involved an emergency, such as war, motivating an enterprising fella to rush in and make an easy buck. Now, of course, we face a prospect of constant emergency, from steadily rising sea levels to increasingly extreme storms to lethal heat waves. It’s a good time to be in the air-conditioning business, is all I’m saying.

But there’s profiting and there’s profiting, if you know what I mean. So in the spirit of Old Testament-style judgment, I thought I’d arrange various ways one might cash in on climate change from least to most evil. Those wanting to make a profit in this arena are advised to stick near the top of this list if they want to keep their souls.

Renewable energy. One hopes, frankly, that there’s a greedy upstart or two out there trying to get rich off solar, wind, geothermal, etc; may they ever proliferate.

Flood mitigation. A proposed set of enormous gates, to be installed south of New York City’s Verrazano-Narrows Bridge as protection from another Hurricane Sandy-like storm surge, might cost something like $10 billion to build—which is frankly a steal given the potential scale of future flooding damage. Per tech website the Verge, flood-defense construction’s an industry that’s “poised to take off”: it might hit $2 billion in the U.S. by 2020.

Trade. Hey, ice might be melting in the Arctic faster than anyplace else in the world, but that’s a boon for shipping. When the Northern Sea Route—along Russia’s Arctic coast and through the Bering Strait—is open, as opposed to frozen, the trip from Europe to China shortens by nearly a third.

Land grabs. Foreseeing a lack of arable land and worrying about food shortages, investors in the U.S., China, and elsewhere are buying up turf around the globe. When “sellers” are coerced by their own governments to play ball (as in Ethiopia and Cambodia), you can see where this might result in a little geopolitical tension. How tangled a web is this? A 2014 study found that Chinese investors had purchased land in 33 countries; Ethiopia had sold land to 21 countries. A study from 2013, meanwhile, guessed that between 0.7 percent and 1.75 of agricultural land worldwide had either already been transferred from local to foreign ownership or was then in the process of being thus grabbed.

Arctic tourism. We recently discussed here a Russian nuclear icebreaker that offers two-week cruises to the North Pole. If you’re thinking about a longer and cushier vacation, the cruise ship Crystal Serenity, with a per-passenger carbon footprint three times that of a 747, will take you from Alaska via Greenland to New York; don’t miss, off the starboard deck, the poignant sight of polar bears starving to death atop dwindling ice floes.

Water. A New York hedge fund called Water Asset Management LLC has begun buying up water rights worldwide in response to increasing drought. In a Bloomberg article on climate-change investment, one financial adviser complains of an “overemphasis on [global warming’s] negative impacts”; kudos to these guys for their glass-half-full optimism, not to mention their pioneering adoption of a new form of economic colonialism. (Yes, moviegoers, you saw this at the very end of The Big Short,where it’s revealed that the Christian Bale character, the hedge-fund wonk who foresaw the housing crash, has since gone all-in on water.)

Arctic drilling. You’ll note the pleasing circularity at work here: by burning enough fossil fuels to warm the earth sufficiently to melt the polar ice caps, we’ve now gained access to yet more fossil fuels buried under those ice caps. There remain some challenges to extracting them: logistical, because the weather up there sucks; political, because Barack Obama placed restrictions on the practice. Still, one Bloomberg analyst said recently he’d be “very surprised” if these hurdles put oil and gas companies off forever. They’re nothing if not plucky.

Then there are cases where the ethics-payoff calculus gets more complicated. We hear lots of kvetching worldwide about the melting of Greenland’s ice sheet, but folks in Greenland are a good deal more sanguine about it—they anticipate that as ice depletion renders minerals, oil, and gas more accessible and improves the local fishery, the island might finally have enough cash on hand to declare its independence from Denmark. So they benefit, albeit in a somewhat fraught manner.

And I haven’t even mentioned the Israeli desalination company now selling snowmaking machines to Alpine ski resorts, the firms providing high-end private firefighting services to rich Californians, or any other of the go-getters who who demonstrate again and again the irrepressible vitality of the free market. The possibilities, really, are endless. Unlike, say, the continued health of the planet.