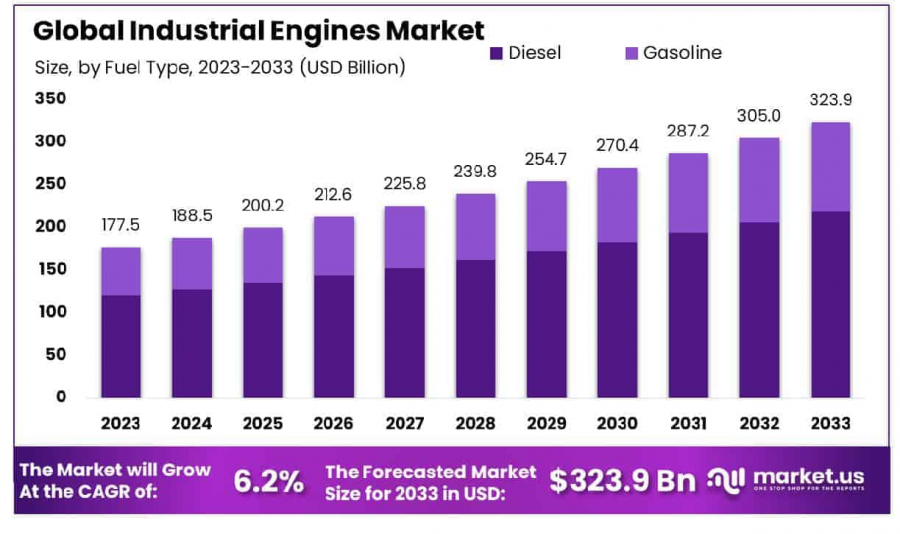

Industrial Engines Market to Reach USD 323.9 Billion by 2033, with a CAGR of 6.20%

Global Industrial Engines Market is projected to reach USD 323.9 Billion by 2033, growing at a CAGR of 6.20% from USD 177.5 Billion in 2023.

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- **Report Overview**

The Global Industrial Engines Market is projected to reach USD 323.9 billion by 2033, up from USD 177.5 billion in 2023, reflecting a CAGR of 6.20% during the forecast period from 2024 to 2033.

Industrial engines are specialized machinery designed to generate mechanical power for industrial applications. They are typically used to power heavy-duty equipment such as generators, compressors, pumps, and construction machinery. These engines vary in size, design, and fuel type, with options including diesel, natural gas, and even hybrid models. Industrial engines play a crucial role in sectors like manufacturing, energy, construction, and transportation, providing reliable and continuous power in demanding environments. Their efficiency, durability, and performance under extreme conditions make them a cornerstone of modern industrial infrastructure.

The industrial engines market encompasses the production, distribution, and consumption of these engines. It is driven by the increasing demand for high-performance, energy-efficient engines in various industries. As global industries scale, the need for reliable power solutions continues to rise, fueling market growth. Technological advancements, such as the development of cleaner, more sustainable engine solutions, are also shaping the market’s future trajectory. The market is characterized by significant investments in R&D to meet evolving regulatory standards, improve fuel efficiency, and reduce emissions.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/industrial-engines-market/request-sample/

Growth in infrastructure development, particularly in emerging economies, along with the rise of automation and electrification in industrial applications, is expected to drive demand in the coming years. The growing emphasis on sustainable energy solutions and the shift toward renewable energy sources also presents substantial opportunities for market players to innovate and expand their product offerings. Additionally, the increasing adoption of electric vehicles and hybrid engines in heavy machinery could open new avenues for growth. The market is positioned for robust expansion, supported by both technological advancements and evolving industrial needs.

**Key Takeaways**

~~ The global industrial engines market is projected to reach USD 323.9 billion by 2033, up from USD 177.5 billion in 2023, growing at a CAGR of 6.20% from 2024 to 2033.

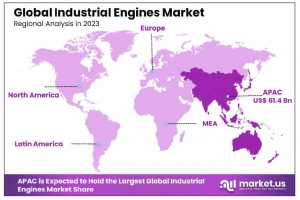

~~ Asia-Pacific held the dominant position in the industrial engines market in 2023, accounting for 34.6% of the total market share, driven by strong industrialization and demand for energy.

~~ Engines in the 500HP to 10,000HP range are the most prominent, constituting 48.2% of the global market share, highlighting the increasing demand for high-power engines in various industrial sectors.

~~ Diesel engines continue to dominate the market, making up 67.6% of the total share. This is due to their reliability, fuel efficiency, and lower operational costs compared to other types of engines.

~~ Four-stroke engines represent the largest share in the market at 62.3%, owing to their higher efficiency and better fuel economy, which make them suitable for long-term industrial operations.

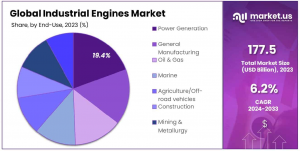

~~ The power generation sector remains a significant consumer, with a market share of 19.4%, reflecting the need for robust, high-performance engines for electricity generation.

**Market Segmentation**

By Power Analysis

In 2023, the 500HP-10,000HP segment led the Industrial Engines Market, capturing 48.2% of the share. This dominance is due to its broad use in industries like manufacturing, mining, and power generation, where high power and reliability are crucial. While the 50HP-500HP segment focuses on cost-effective, fuel-efficient engines for lighter applications, and engines above 10,000HP serve niche, high-power needs, the 500HP-10,000HP range remains key due to advancements in engine efficiency and environmental compliance. This segment’s growth is also fueled by its role in renewable energy and large infrastructure projects, with further expansion expected as industrial demands evolve.

By Fuel Type Analysis

In 2023, diesel engines maintained a dominant 67.6% share of the Industrial Engines Market, driven by their efficiency, durability, and high torque performance in heavy-duty applications like generators, construction machinery, and marine vessels. Diesel's versatility and reliability make it the preferred choice for demanding environments, whereas gasoline engines, with their quieter operation and lower emissions, hold a smaller market share due to limitations in power and efficiency. Technological advancements are further enhancing diesel engines' fuel efficiency and sustainability, ensuring their continued dominance in the market as industrialization and infrastructure development drive demand for reliable power solutions.

By Type Analysis

In 2023, 4-stroke engines dominated the Industrial Engines Market, holding 62.3% of the market share. Their popularity stems from superior efficiency, better fuel economy, lower emissions, and overall reliability, making them ideal for industrial machinery like generators, pumps, and construction equipment. In contrast, 2-stroke engines have a smaller market share due to their lower efficiency and higher emissions, despite offering advantages in simplicity and power-to-weight ratio. Ongoing advancements in technology continue to strengthen the dominance of 4-stroke engines, ensuring their preference in industrial applications.

By End-Use Analysis

In 2023, the Power Generation segment dominated the Industrial Engines Market, capturing 19.4% of the market share, driven by the critical role of industrial engines in powering generators and backup systems for reliable electricity supply. This segment is vital across industries, commercial establishments, and infrastructure, ensuring operational continuity during grid outages and in remote areas. While other segments like General Manufacturing, Oil & Gas, and Construction also rely on industrial engines, their market dynamics are influenced by specific sector conditions. The Power Generation segment is expected to maintain its dominance, fueled by rising demand for efficient power solutions in emerging economies and remote regions, along with advancements in engine technology focused on improving fuel efficiency and emissions control.

**Key Market Segments**

By Power

~~ 50HP-500HP

~~ 500HP-10,000HP

~~ Above 10,000HP

By Fuel Type

~~ Diesel

~~ Gasoline

By Type

~~ 2 Stroke

~~ 4 Stroke

By End-Use

~~ Power Generation

~~ General Manufacturing

~~ Oil & Gas

~~ Marine

~~ Agriculture/Off-road vehicles

~~ Construction

~~ Mining & Metallurgy

~~ Others

Purchase the Market Report Now and Save Up to 30% at https://market.us/purchase-report/?report_id=13286

**Driving factors**

Increasing Demand for Energy-Efficient Industrial Engines

One of the primary drivers of growth in the global industrial engines market in 2024 is the rising demand for energy-efficient engines. With industries across the globe under pressure to reduce operational costs and minimize their environmental impact, energy-efficient engines have become a key focus. These engines help in lowering fuel consumption, reducing greenhouse gas emissions, and improving operational productivity. As regulatory frameworks become stricter in many regions, industrial operations are increasingly seeking engines that meet these enhanced fuel efficiency and emission standards. Energy-efficient engines help manufacturers and operators comply with regulations while optimizing their bottom line.

**Restraining Factors**

High Initial Investment Costs

Despite the growing demand for industrial engines, the high initial investment cost remains a significant restraint in the market's growth in 2024. Advanced industrial engines, especially those designed for high efficiency or those incorporating new technologies like hybrid or electric engines, tend to come with a hefty price tag. This upfront cost can be a major hurdle for small to medium-sized enterprises (SMEs) and even larger corporations with budget constraints. Many businesses are hesitant to make large capital expenditures, especially when the return on investment (ROI) from adopting such engines may take several years to realize.

**Growth Opportunity**

Expanding Adoption of Electric and Hybrid Engines

The growing trend toward electrification and hybridization in the industrial sector presents a significant opportunity for the industrial engines market. As industries look to decarbonize and reduce reliance on fossil fuels, the demand for electric and hybrid engines is expected to rise substantially in the coming years. These engines offer lower emissions, reduced maintenance costs, and improved operational efficiency compared to their traditional counterparts. Companies are increasingly exploring the use of electric and hybrid engines for applications like construction machinery, material handling equipment, and marine vessels, all of which are critical in the industrial sector.

**Latest Trends**

Increasing Automation and Smart Technologies in Industrial Engines

The integration of automation and smart technologies into industrial engines is a prevailing trend shaping the market in 2024. As industries continue to prioritize digital transformation, there is an increasing demand for engines equipped with sensors, IoT capabilities, and advanced control systems. These smart engines not only provide better performance but also enable predictive maintenance, real-time monitoring, and enhanced operational optimization. This shift towards connected engines helps reduce downtime, enhance productivity, and streamline maintenance processes, leading to significant cost savings over time.

!! Request Your Sample PDF to Explore the Report Format !!

**Regional Analysis**

Asia-Pacific Leads the Industrial Engines Market with 34.6% Share in 2023

The industrial engines market is led by the Asia-Pacific region, which holds a dominant share of 34.6% in 2023, valued at USD 61.4 billion. This growth is fueled by rapid industrialization and rising demand in countries like China, India, and Japan. North America follows with steady growth driven by investments in sectors such as automotive and energy. Europe sees moderate expansion, particularly in energy-efficient technologies, with key markets in Germany, the UK, and France. The Middle East and Africa are experiencing gradual growth, led by oil and gas and construction sectors, while Latin America grows at a slower pace due to economic volatility but remains driven by manufacturing and construction in Brazil and Mexico.

**Key Players Analysis**

The global industrial engines market in 2024 remains highly competitive, with several key players continuing to dominate through technological advancements and robust product portfolios. Caterpillar Inc. and Cummins Inc. lead the market with their extensive range of diesel and gas engines, offering high-performance solutions for sectors like construction, agriculture, and mining. Volvo Group and Deutz AG are also significant players, focusing on fuel efficiency and eco-friendly solutions to meet evolving regulatory standards. Kubota Corporation and Yanmar Co., Ltd. cater to both agricultural and industrial needs, integrating compact engine designs with advanced power generation capabilities.

Wärtsilä Corporation and MTU Friedrichshafen GmbH are pushing the boundaries of sustainable engine technologies, especially in marine and power generation sectors. Doosan Infracore and MAN SE are notable for their expertise in heavy-duty engines, emphasizing durability and operational efficiency. Meanwhile, John Deere continues to lead in agricultural and construction machinery, offering tailored engine solutions for specific industrial applications. The ongoing innovation and investment by these companies will shape market dynamics in 2024 and beyond.

Top Key Players in the Market

~~ Caterpillar Inc.

~~ Cummins Inc.

~~ Volvo Group

~~ Deutz AG

~~ Kubota Corporation

~~ Wärtsilä Corporation

~~ Yanmar Co., Ltd.

~~ MTU Friedrichshafen GmbH

~~ Doosan Infracore

~~ MAN SE

~~ John Deere

**Recent Developments**

~~ April 2024: Achates Power (with U.S. Department of Energy support) developed hydrogen-fueled opposed-piston engines, advancing propulsion technology for cleaner, efficient vehicles, backed by a $133 million investment.

~~ March 2024: DLR successfully tested its LUMEN liquid-fueled rocket engine for system-level and component validation, providing a cost-effective platform for space propulsion development.

~~ February 2024: China accelerates development of high-tech and future industries, focusing on quantum technology and NEVs in Hefei, with increased investments and talent expansion driving economic growth.

**Conclusion**

The global industrial engines market is poised for robust growth, with a projected increase from USD 177.5 billion in 2023 to USD 323.9 billion by 2033, reflecting a CAGR of 6.20%. This growth is driven by rising industrial demand for energy-efficient, high-performance engines across various sectors like manufacturing, construction, and power generation. Technological advancements, including hybridization, electrification, and smart technologies, are reshaping the market, offering new opportunities for innovation and sustainability. While the high initial investment costs remain a challenge, the expanding adoption of energy-efficient and electric engines, along with increasing automation, presents significant growth prospects. With Asia-Pacific leading the market and key players continuing to invest in cutting-edge technologies, the industrial engines market is set for continued expansion in the coming years.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Manufacturing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release