Air Compressor Market Sales to Top USD 43.9 Bn by 2033 | With Top-Growing Players: Atlas Copco, Camfil

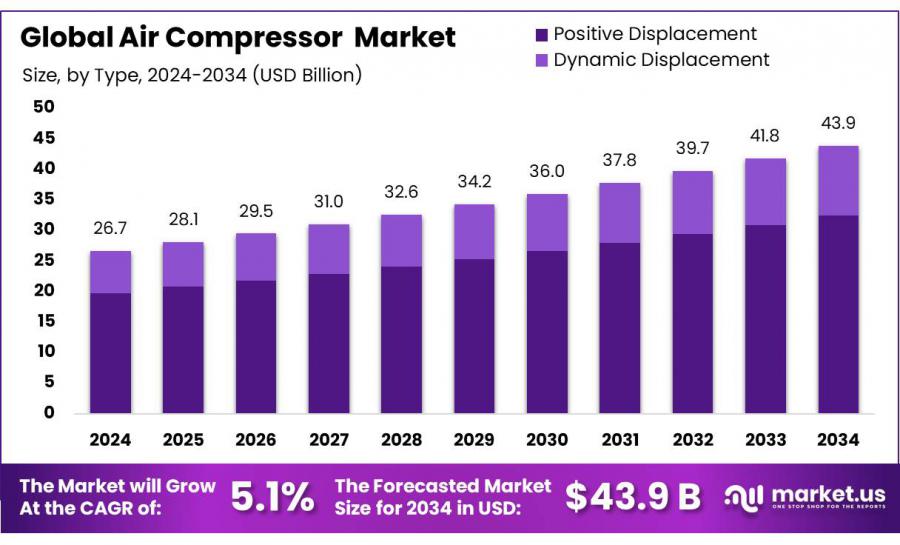

Air Compressor Market size is expected to be worth around USD 43.9 Bn by 2033, from USD 26.7 Bn in 2023, at a CAGR of 5.1% during the period from 2024 to 2033.

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- The global Air Compressor Market is a dynamic and integral part of the industrial landscape, characterized by its essential role in various manufacturing, construction, and industrial processes. Air compressors, which convert power into potential energy stored as compressed air, are pivotal in numerous industrial applications, ranging from simple pneumatic equipment operations to complex, automated manufacturing systems. This critical functionality underscores their ubiquitous presence across diverse sectors such as manufacturing, oil and gas, healthcare, and automotive.

The demand for air compressors, driven by their essential applications in sectors that require reliable and efficient pneumatic power. As industries increasingly focus on energy efficiency and reduced operational costs, the adoption of advanced compressor technologies such as rotary screw, centrifugal, and reciprocating compressors has surged. These technologies are favored not only for their efficiency but also for their ability to operate continuously under harsh industrial conditions, thereby enhancing productivity and operational reliability.

Driving factors for the air compressor market include rapid industrialization in emerging economies and growing technological advancements in compressor design and functionality. The shift towards oil-free compressors in industries such as food and beverage, pharmaceuticals, and electronics manufacturing is particularly noteworthy, driven by stringent regulatory standards regarding product purity and environmental sustainability. These regulations compel industries to adopt air compressors that minimize the risk of contamination and reduce environmental impact, thereby aligning with global trends toward sustainability and compliance with environmental regulations.

The integration of the Internet of Things (IoT) and other smart technologies into air compressor systems is transforming the market landscape. These technologies enhance monitoring and control capabilities, allowing for real-time data analysis and predictive maintenance. This shift not only improves the efficiency and longevity of compressor systems but also supports the trend toward automation and data-driven operations in industrial settings.

The future growth opportunities for the air compressor market are substantial. The expansion of industries in Asia-Pacific, particularly in China and India, is expected to continue driving demand due to these regions' significant industrial growth, increased infrastructural investments, and the rising adoption of advanced manufacturing practices. Additionally, the ongoing development of more energy-efficient, lower-emission compressor technologies presents significant growth potential, especially in light of the increasing global focus on energy efficiency and emission control.

Make Informed Decisions With Our Comprehensive Market Reports - Get Your Sample Now! https://market.us/report/air-compressor-market/free-sample/

Key Takeaways

• The Global Air Compressor Market size is expected to be worth around USD 55.9 Billion by 2033, from USD 35.3 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

• In 2023, Stationary Compressor held a dominant market position in the By Compressor Type segment of the Air Compressor Market, with a 58.4% share.

• In 2023, Rotary Screw Compressors held a dominant market position in the By Mechanism segment of the Air Compressor Market, with a 63.2% share.

• In 2023, Oil Filled held a dominant market position in the Lubrication segment of the Air Compressor Market, with a 65.1% share.

• In 2023, Manufacturing held a dominant market position in the By End-Use Industry segment of the Air Compressor Market, with a 28% share.

• Asia Pacific dominated a 36.5% market share in 2023 and held USD 12.9 Billion in revenue from the Air Compressor Market.

Air Compressor Top Trends

⦿ Increased Efficiency and Energy Recovery: Manufacturers are focusing on producing air compressors that are not only more efficient but also capable of energy recovery. This trend is driven by the growing demand for sustainable and energy-efficient technologies.

⦿ Oil-Free Compressor Technology: There is a noticeable shift towards oil-free compressors, especially in critical industries such as food and beverage and pharmaceuticals, where contamination must be avoided. These compressors reduce the risk of oil contamination and are also more environmentally friendly.

⦿ Advancements in Smart Compressor Technologies: The integration of IoT and smart monitoring systems in air compressors is on the rise. These technologies enhance predictive maintenance capabilities, allowing for better management of compressor performance and timely maintenance, thus reducing downtime.

⦿ Portable and Modular Compressors: The demand for portable air compressors is increasing, particularly in construction and mining sectors where mobility and flexibility are crucial. Modular compressors are also gaining popularity as they allow for easy customization and scalability according to the user's needs.

⦿ Focus on Noise Reduction and Air Quality: As regulatory standards on noise and air quality tighten, compressors are being designed to operate more quietly and with better air quality outputs. This not only helps in complying with regulations but also improves the workplace environment.

Key Market Segments

By Type Analysis

In 2024, Positive Displacement air compressors held a dominant market position, capturing more than 74.60% of the total market share. This strong presence can be attributed to their versatility and efficiency, making them the go-to choice for industries requiring steady and high-pressure airflow. Positive Displacement compressors, which include reciprocating, rotary, and screw types, continue to be the preferred option across a wide range of applications due to their ability to handle both high-pressure demands and varied operational conditions.

By Design

In 2024, Stationary air compressors held a dominant market position, capturing more than 64.30% of the total market share. This significant share was driven by the widespread adoption of stationary compressors across various industries, where the need for reliable, long-term compressed air solutions is paramount. Stationary air compressors are typically used in settings where a fixed, continuous source of compressed air is needed, such as in manufacturing plants, automotive workshops, and large-scale industrial operations.

By Operating Mode

In 2024, Electric air compressors held a dominant market position, capturing more than 78.30% of the total market share. This dominance can be attributed to the increasing preference for electric-powered compressors across a wide range of industries. Electric compressors offer numerous advantages, including energy efficiency, lower operating costs, and ease of maintenance, making them the ideal choice for many industrial applications.

By Technology

In 2024, Oil-Free air compressors held a dominant market position, capturing more than 67.10% of the total market share. This strong market presence is largely due to the increasing demand for clean, contaminant-free compressed air in a wide range of industries, especially those where the quality of air is critical, such as in the food and beverage, healthcare, and pharmaceutical sectors. Oil-Free compressors are preferred because they eliminate the risk of oil contamination, which can affect product quality and lead to costly maintenance issues.

By Coolant Type

In 2024, Air-cooled air compressors held a dominant market position, capturing more than 57.40% of the total market share. This significant market share can be attributed to their simplicity, reliability, and cost-effectiveness, which make them the preferred choice for a wide range of industries. Air-cooled compressors are particularly valued in smaller to medium-scale operations where space and budget constraints play a key role. These compressors are designed to use ambient air to cool the system, eliminating the need for external cooling systems, making them easier to install and maintain.

By Power Range

In 2024, 51-250 KW air compressors held a dominant market position, capturing more than 38.30% of the total market share. This segment's strong performance can be attributed to the versatility and power these compressors offer for a wide range of industrial applications. The 51-250 KW power range is ideal for medium to large-scale operations that require a reliable and consistent air supply for powering equipment, tools, and machinery. Industries such as manufacturing, automotive, and construction continue to rely heavily on this power range to meet their air compression needs.

By Pressure Range

In 2024, the Up to 20 Bar segment held a dominant position in the air compressor market, capturing more than a 53.40% share. This pressure range is widely preferred across industries such as manufacturing, automotive, and food and beverage due to its versatility and efficiency in handling tasks like pneumatic tools, packaging, and assembly line operations. The affordability and lower maintenance costs of compressors in this category further enhance their adoption, making them a popular choice for small to medium-scale applications. The growing emphasis on energy-efficient and compact air compressors in these industries has also bolstered the demand for this segment.

By End-use

In 2024, the Chemical & Petrochemical segment held a dominant market position in the air compressor market, capturing more than a 27.80% share. Air compressors play a critical role in this industry, providing compressed air for processes such as pneumatic conveying, chemical synthesis, and gas compression. The rising demand for petrochemical products and the expansion of chemical manufacturing facilities globally have significantly driven the adoption of air compressors in this segment. Additionally, the need for reliable, high-performance equipment in hazardous and corrosive environments has further increased the preference for advanced air compressor systems.

Key Market Segments List

By Type

◘ Positive Displacement

—— Reciprocating

—— Rotary

——— Screw

——— Scroll

——— Others

◘ Dynamic Displacement

—— Centrifugal

—— Axial

By Design

◘ Stationary

◘ Portable

By Operating Mode

◘ Electric

◘ Internal Combustion Engine

By Technology

◘ Oil-Injected

◘ Oil-Free

By Coolant Type

◘ Air-cooled

◘ Water-cooled

By Power Range

◘ Up to 50 KW

◘ 51-250 KW

◘ 251-500 KW

◘ Above 500 KW

By Pressure Range

◘ Up to 20 Bar

◘ 21-100 Bar

◘ Above 100 Bar

By End-use

◘ Chemical & Petrochemical

◘ Healthcare & Medical

◘ Metals & Mining

◘ Oil & Gas

◘ Automotive & Transportation

◘ Food & Beverage

◘ Energy & Power

◘ Building & Construction

◘ Others

Regulations On the Air Compressor Market

⦿ Energy Efficiency Standards: The U.S. Department of Energy (DOE) has established specific energy conservation standards for air compressors, particularly focusing on rotary screw types. These standards, set to take effect in January 2025, define minimum efficiency levels that must be met and consider factors such as compressor type, capacity, and application. These regulations aim to promote energy-efficient technologies and reduce environmental impact.

⦿ Safety and Environmental Regulations: Air compressors must adhere to safety standards to ensure the protection of both users and the environment. These include guidelines for machine safety under the EU's Machinery Directive and environmental considerations in the design and operation of compressors. Standards often address performance, quality, and environmental impact, and are used by legislators to ensure uniformity in market practices.

⦿ Operational Standards and Compliance: International and national standards, such as those from ISO and the European Committee for Standardization, are frequently referenced in the industry. These standards can become binding through legislation or commercial agreements and cover various aspects from safety to operational efficiency.

⦿ Market-Specific Requirements: Different markets may have specific requirements or standards that relate to the application of air compressors. For example, industries such as pharmaceuticals or food production may have stricter air purity requirements, leading to higher adoption of oil-free compressors that comply with these stringent standards.

Get Up to 30% Off Your Purchase! https://market.us/purchase-report/?report_id=44624

Regional Analysis

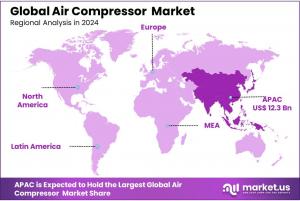

Asia Pacific led the global air compressor market with a 36.5% share, generating revenues of USD 12.9 billion. This region's growth is fueled by rapid industrialization and an expanding manufacturing base, particularly in China, India, and Southeast Asia, along with significant investments in infrastructure and automation.

Europe and North America also held significant shares, driven by mature industrial sectors and stringent regulations that encourage the adoption of energy-efficient and environmentally friendly technologies. Middle East & Africa and Latin America, though smaller in market size, are seeing growth from increasing industrial activities and infrastructure developments, with a notable demand in resource extraction and construction industries.

Key Players Analysis

• Atlas Copco AB

• Camfil

• Hitachi, Ltd.

• Mitsubishi Heavy Industries, Ltd.

• Kaeser Kompressoren, Inc.

• FS-Curtis

• Ingersoll Rand Inc.

• Doosan Group

• KOBELCO COMPRESSORS CORPORATION

• Elliott Group

• Kirloskar Pneumatic Co Ltd

• Danfoss

• Baker Hughes Company

• Sulzer Ltd.

• Siemens AG

• BOGE KOMPRESSOREN

• Other Key Players

Conclusion

The Air Compressor Market is undergoing significant transformations driven by advancements in technology, evolving industrial demands, and stringent environmental regulations. With oil-filled compressors dominating due to their reliability and efficiency in rigorous industrial applications, and the manufacturing sector maintaining its position as the largest end-user, the market's foundation is robust.

Geographically, Asia Pacific is at the forefront, propelled by rapid industrialization and infrastructural developments, whereas regions like Europe and North America continue to innovate and implement energy-efficient solutions in response to regulatory pressures. The global air compressor market is poised for sustained growth, adapting to the dual demands of performance and environmental sustainability. This dynamic market landscape offers abundant opportunities for manufacturers and end-users alike to leverage technological advancements for operational improvement and compliance with global standards.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release