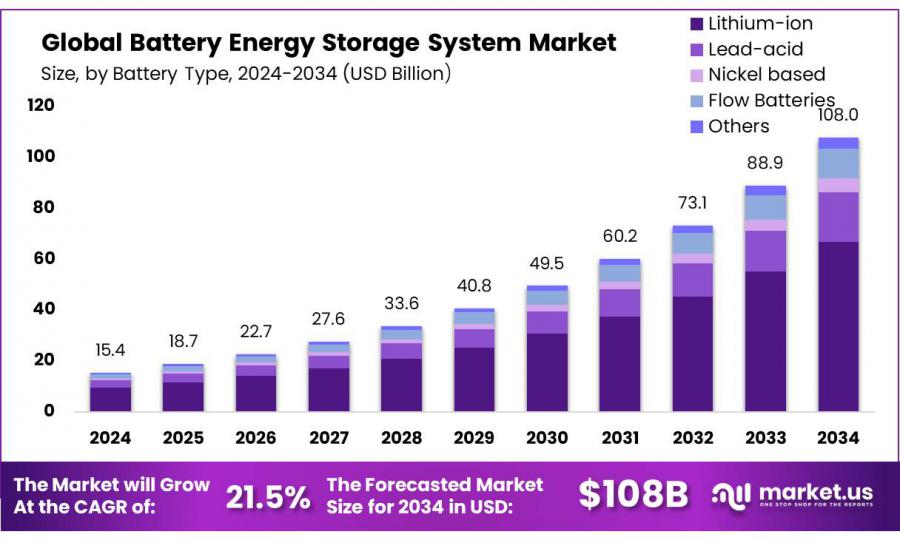

Battery Energy Storage Systems Market Projected to Reach USD 108.0 Billion by 2034, Growing at a CAGR of 21.5%

Battery Energy Storage Systems Market size is expected to be worth around USD 108.0 billion by 2034, from USD 15.4 billion in 2024, growing at a CAGR of 21.5%

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- Report Overview

Battery Energy Storage Systems (BESS) are technologies designed for storing electrical energy generated from power plants or renewable sources like solar and wind, to be used later. These systems play a critical role in energy grids, providing stability by balancing supply and demand, supporting load leveling, peak shaving, and emergency power backups. BESS includes various battery types such as lithium-ion, lead-acid, and flow batteries, each with unique advantages in energy density, life cycle, and efficiency.

The Battery Energy Storage Systems Market is a rapidly growing sector driven by the increasing adoption of renewable energy sources and the global push for energy efficiency. This market encompasses the production, distribution, and integration of battery storage systems across residential, commercial, and industrial sectors. As grid modernization efforts intensify and renewable penetration increases, the demand for advanced storage solutions that can efficiently manage intermittent energy supplies and stabilize grids is surging.

One major growth factor in the BESS market is the technological advancements in battery technology. Improvements in lithium-ion batteries, with higher energy densities and longer lifecycles, are particularly significant. Additionally, the development of solid-state batteries and advancements in materials science that reduce costs and enhance the performance of storage systems contribute to market growth. These technological enhancements enable more efficient energy storage solutions, making BESS more attractive for a broader range of applications.

The demand for BESS is primarily fueled by the increasing integration of renewable energy sources into the power grid. As solar and wind resources become more prevalent, the need for reliable energy storage solutions to manage supply variability and ensure consistent power supply grows. Additionally, regulatory policies and incentives promoting renewable energy adoption significantly boost the demand for energy storage solutions, as they are essential for managing renewable generation effectively.

The transition towards renewable energy and the electrification of transport provides significant opportunities for the BESS market. Energy storage is crucial in managing the higher variability and decentralization of energy resources that come with renewable energy systems. Furthermore, the growing electric vehicle (EV) market indirectly supports the BESS market through developments in battery technology and manufacturing processes that are common to both domains.

Government policies and regulatory frameworks are the primary driving factors behind the expansion of the BESS market. Initiatives such as subsidies, tax incentives, and supportive regulations for energy storage deployment encourage investment in BESS projects. Additionally, the increasing need for grid modernization and resilience against power outages and electricity demand fluctuations drives the adoption of battery energy storage systems across various sectors.

Get a Sample PDF Report: https://market.us/report/battery-energy-storage-systems-market/request-sample/

Key Takeaway

• Battery Energy Storage Systems market size is expected to be worth around USD 108.0 billion by 2034, from USD 15.4 billion in 2024, growing at a CAGR of 21.5%.

• Lithium-ion held a dominant market position, capturing more than a 62.10% share.

• Above 500 MWh held a dominant market position, capturing more than a 37.20% share.

• On-grid systems held a dominant market position, capturing more than a 74.20% share.

• Third-party-owned systems held a dominant market position, capturing more than a 43.20% share.

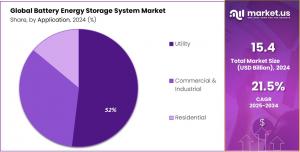

• The utility segment held a dominant market position, capturing more than a 52.10% share.

Battery Energy Storage Systems Market Segment Analysis

By Battery Type Analysis

In 2024, Lithium-ion batteries dominated the global BESS market with a 62.10% share, favored for their efficiency and long lifespan in grid-scale storage. Lead-acid batteries, though declining, remained utilized in off-grid applications due to their low cost and recyclability. Nickel-based batteries were preferred in industrial settings for their durability, while flow batteries, especially VRFBs, saw increased use in long-duration, utility-scale storage projects due to their stable, long-term performance.

By Capacity Analysis

In 2024, the Above 500 MWh segment led the global BESS market with a 37.20% share, propelled by the surge in utility-scale energy storage driven by investments from governments and private sectors for better grid stability and renewable energy integration. The 100 to 500 MWh range was also significant, favored in commercial and medium-scale grid projects for its cost-effective storage solutions. Meanwhile, the Below 100 MWh segment catered to smaller-scale needs in commercial buildings, small industries, and community projects, benefiting from the rise in electric vehicle infrastructure and decentralized energy systems.

By Connection Type Analysis

In 2024, On-grid battery energy storage systems (BESS) dominated the market with a 74.20% share, driven by their crucial role in stabilizing public electricity grids, managing peak loads, and storing excess renewable energy. Conversely, off-grid systems, though smaller in market share, were indispensable in remote and rural areas lacking reliable grid connectivity. These systems provided essential power to standalone applications such as residential homes, remote industrial sites, and critical emergency power systems.

By Ownership Analysis

In 2024, third-party-owned systems led the BESS market with a 43.20% share, bolstered by ESCOs offering battery storage as a service, which eliminates upfront costs for commercial and industrial clients. Customer-owned systems also claimed a substantial market portion, favored by homeowners and businesses desiring control over their energy use and independence, supported by government incentives. Additionally, utility-owned systems were crucial for managing loads, integrating renewables, and stabilizing the grid, essential for large-scale storage applications supporting broader grid functionality.

By Application Analysis

In 2024, the Utility segment led the BESS market, accounting for over 52.10%, driven by utilities' increased use of large-scale storage for peak load management, grid stability, and renewable integration. The Commercial & Industrial sectors also experienced significant growth as businesses aimed to cut energy costs and enhance reliability through energy storage for demand management and backup power.

The Transportation sector played a vital role in the electric vehicle infrastructure, offering load balancing and renewable energy storage for charging solutions amid rising transport electrification. Critical Infrastructure, including hospitals and data centers, increasingly depended on BESS for reliable, uninterrupted power, while the Infrastructure & Commercial

Buy Now: https://market.us/purchase-report/?report_id=36952

Key Market Segments

By Battery Type

• Lithium-ion

— Lithium Cobalt Oxide (LCO)

— Lithium Manganese Oxide (LMO)

— Lithium Nickel Manganese Cobalt Oxide (NMC)

— Lithium Nickel Cobalt Aluminum Oxide (NCA)

— Lithium Iron Phosphate (LFP)

— Lithium Titanate Oxide (LTO)

• Lead-acid

• Nickel based

• Flow Batteries

• Others

By Capacity

• Below 100 MWh

• 100 to 500 MWh

• Above 500 MWh

By Connection Type

• On-grid

• Off-grid

By Ownership

• Third-party-owned

• Customer-owned

• Utility-owned

By Application

• Utility

• Commercial & Industrial

— Transportation

— Critical Infrastructure

— Infrastructure & Commercial Buildings

— Others

• Residential

Top Emerging Trends

1. Advancements in Lithium-Ion Technology: Lithium-ion batteries continue to dominate the battery energy storage market due to ongoing advancements that enhance their efficiency and storage capacity. Researchers and manufacturers are focused on improving the electrode materials and battery design to increase life span and reduce costs. These enhancements make lithium-ion batteries more suitable for large-scale energy storage applications, boosting their adoption in both residential and commercial sectors.

2. Solid-State Batteries Breakthrough: Solid-state batteries represent a significant trend due to their higher safety and energy density compared to traditional lithium-ion systems. As these batteries eliminate liquid electrolytes, they reduce the risk of fire hazards and increase energy capacity. The transition to solid-state technology is expected to revolutionize the market by providing more robust and longer-lasting energy storage solutions, especially appealing in electric vehicles and portable electronics, impacting stationary storage uses.

3. Integration with Renewable Energy: The push towards renewable energy sources is creating a surge in demand for effective storage solutions. Battery energy storage systems are increasingly integrated with solar and wind installations to manage intermittent energy supply and stabilize the grid. This trend is particularly strong in regions with high renewable penetration, where BESS helps in maximizing the utilization of generated renewable energy and ensuring a steady, reliable power supply.

4. Decreasing Costs, Increasing Accessibility: A key trend in the BESS market is the declining cost of battery production, largely due to advancements in technology and increased production scale. As batteries become more affordable, energy storage systems are more accessible, which drives their adoption across a broader range of industries and residential areas. This trend is crucial for the expansion of energy storage solutions in developing regions, enhancing global energy equity.

5. Regulatory and Policy Support: Governments worldwide are recognizing the importance of energy storage in achieving energy and climate goals. Increased regulatory support, including incentives like tax breaks and subsidies, and clear policies favoring the adoption of BESS, are pivotal trends. This supportive environment encourages further investments and the deployment of energy storage technologies, accelerating market growth and innovation in the sector.

Regulations on the Battery Energy Storage Systems Market

India is actively advancing its Battery Energy Storage Systems (BESS) market through a series of regulatory frameworks and policy initiatives aimed at bolstering renewable energy integration and ensuring grid stability.

In March 2024, the Ministry of Power introduced operational guidelines for a Viability Gap Funding (VGF) scheme, targeting the development of BESS projects with a cumulative capacity of 4,000 MWh by the fiscal year 2030-31. This initiative seeks to incentivize investments in large-scale storage solutions via competitive bidding processes.

Further strengthening the policy landscape, the National Framework for Promoting Energy Storage Systems was unveiled in September 2023. This framework outlines objectives such as achieving 24×7 dispatchable renewable energy, reducing greenhouse gas emissions, and establishing technical standards to ensure the safety, reliability, and interoperability of energy storage systems within the grid.

Projections within the framework estimate that by 2029-30, India will require approximately 60.63 GW of energy storage capacity, comprising 18.98 GW from Pumped Storage Projects (PSP) and 41.65 GW from BESS, with a total storage capacity of 336.4 GWh.

In alignment with these initiatives, the Ministry of Environment, Forest, and Climate Change issued the Battery Waste Management Rules in August 2023. These regulations mandate the environmentally sound management of used batteries, encompassing aspects such as collection, recycling, and disposal, thereby promoting sustainable practices within the burgeoning energy storage sector.

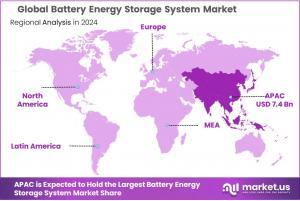

Regional Analysis

The Battery Energy Storage Systems (BESS) market is experiencing rapid growth, with Asia-Pacific leading the charge, holding a dominating share of 48.30% and a market valuation of USD 7.4 billion.

This region benefits from substantial investments in renewable energy, primarily in countries like China, Japan, and South Korea, which are aggressively integrating BESS to stabilize their grids against fluctuating renewable outputs. The robust manufacturing base, decreasing costs of battery production, and significant governmental incentives further contribute to the region's predominance in the market.

North America follows, with advanced grid infrastructure and a high rate of technology adoption driving demand for BESS. The U.S. and Canada are focusing on upgrading their energy storage capabilities to enhance grid reliability and to increase the penetration of renewables. The presence of major players and supportive regulatory frameworks help sustain the region's substantial market share.

In Europe, the emphasis on reducing carbon footprints and the presence of stringent regulatory mandates to adopt cleaner energy sources propel the adoption of BESS. Countries such as Germany, the UK, and France are leading in terms of BESS deployment, driven by growing renewable installations and the need for efficient energy management systems.

The Middle East & Africa, though a smaller market, is witnessing growing interest in BESS due to increasing renewable energy projects and the need for energy diversification. The Gulf countries, in particular, are investing in BESS to enhance energy security and manage the high variability of solar energy contributions.

Latin America is gradually catching up, with countries like Brazil and Chile exploring BESS to stabilize their renewable-heavy grids and to improve rural electrification. The region shows promising growth potential, backed by evolving regulations and increasing foreign investments in energy infrastructure.

Key Players Analysis

◘ BYD Co. Ltd.

◘ General Electric

◘ Panasonic Corporation

◘ LG Energy Solution Ltd

◘ Tesla Inc

◘ Contemporary Amperex Technology Co., Limited.

◘ Samsung SDI Co., Ltd.

◘ AEG

◘ Varta AG

◘ Delta Electronics, Inc.

◘ Hitachi Energy Ltd.

◘ Honeywell International Inc.

◘ Siemens AG

◘ Toshiba Corporation

◘ Mitsubishi Heavy Industries, Ltd.

◘ Other Key Players

Recent Developments Battery Energy Storage Systems Market

— In 2023, BYD has experienced significant growth in the electric vehicle (EV) sector. The company sold approximately 3 million passenger cars, marking a substantial increase from 1.8 million in 2022.

— In 2023, CATL has maintained its position as the world's largest EV battery manufacturer, with a global market share of around 37% in 2023.

— In November 2022, Panasonic has been expanding its battery production capabilities, particularly in the EV sector. The company broke ground on a $4 billion EV battery plant in Kansas, USA.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release