Gas Chromatography Market To Surpass USD 5.0 Billion By 2033 | Instruments, Accessories and Consumables, Reagents

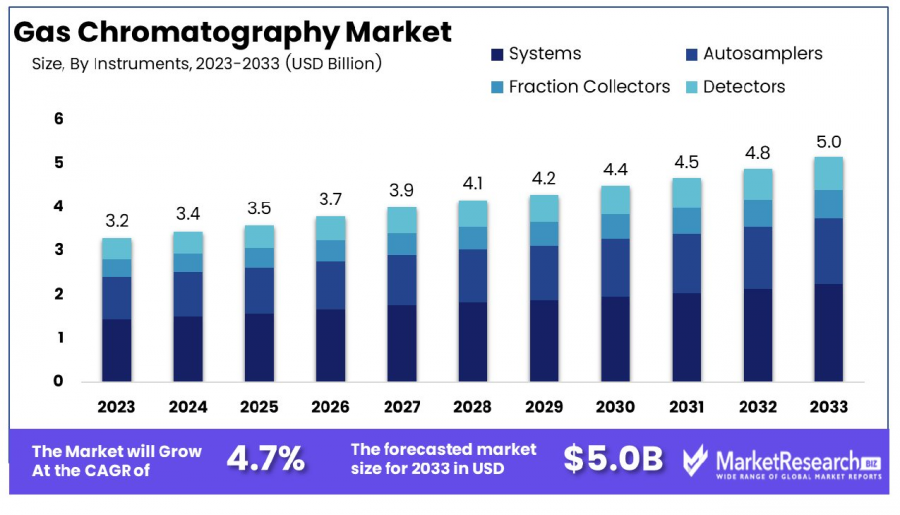

Global Gas Chromatography Market was valued at USD 3.2 Bn in 2023. It is expected to reach USD 5.0 Bn by 2033, with a CAGR of 4.7%

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- Report Overview

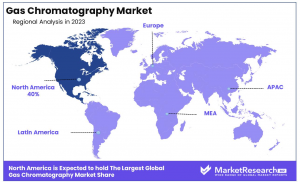

The Global Gas Chromatography Market was valued at USD 3.2 Bn in 2023. It is expected to reach USD 5.0 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033. North America remains the largest market for gas chromatography, with a 40% share.

Gas Chromatography (GC) is a powerful analytical technique widely used for separating and analyzing compounds that can be vaporized without decomposition. It plays a pivotal role in industries such as pharmaceuticals, environmental monitoring, food safety, and petrochemicals.

The process of GC involves the separation of a sample into its individual components. The sample is introduced into the instrument and carried by an inert gas (usually helium or nitrogen) through a column coated with a stationary phase. As the sample components interact with the stationary phase, they are separated based on their affinity and vaporization properties. The separated compounds are detected and quantified using detectors like flame ionization detectors (FID) or mass spectrometers (MS).

The accuracy and sensitivity of GC make it invaluable for applications such as identifying contaminants, measuring product purity, and analyzing complex mixtures. Recent advancements in column technology and detector sensitivity have further enhanced the capabilities of GC, allowing faster analysis and greater precision.

The market for GC is driven by stringent regulatory requirements, especially in environmental and pharmaceutical sectors. Increasing demand for high-quality products and the need to monitor pollutants in air and water are also boosting its adoption. Portable GC systems are gaining popularity due to their convenience in field analysis. Emerging trends in GC include miniaturized systems, improved sample preparation techniques, and coupling with advanced mass spectrometry systems for better molecular analysis. The integration of artificial intelligence is also paving the way for automated and more efficient GC workflows.

Unlock Competitive Advantages With Our PDF Sample Report @ https://marketresearch.biz/report/gas-chromatography-market/request-sample/

Key Takeaways

Market Value: The global gas chromatography market was valued at USD 3.2 billion in 2023 and is projected to reach USD 5.0 billion by 2033, growing at a CAGR of 4.7% between 2024 and 2033.

By Instruments: Gas chromatography systems dominate the instrument segment, contributing 45% of the market share.

By Accessories and Consumables: Columns and related accessories account for 30% of the accessories and consumables segment in the market.

By Reagents: Analytical reagents hold the largest share in the reagents segment, making up 60% of the total market.

By End User: The pharmaceutical sector emerges as a key end-user, representing 30% of the market share.

Regional Dominance: North America leads the market with a 40% share, driven by a strong pharmaceutical industry and extensive research and development activities.

Growth Opportunity: Increasing demand for precise and efficient analytical techniques in pharmaceuticals, environmental testing, and food safety is fueling market expansion.

How Artificial Intelligence (AI) is Changing the Gas Chromatography Market?

1. Automated Data Analysis: AI enables real-time data processing and pattern recognition, reducing human intervention. Algorithms can identify complex compounds faster, improving the reliability of results and saving time.

2. Enhanced Predictive Maintenance: AI monitors GC systems, predicting component failures and optimizing maintenance schedules. This minimizes downtime and extends the lifespan of expensive equipment.

3. Improved Method Development: Machine learning models optimize GC parameters, such as temperature programming and column selection, reducing the trial-and-error process and speeding up method development.

4. Workflow Automation: AI-driven automation in GC workflows enables seamless sample handling, data collection, and reporting. This increases throughput and decreases human errors, making GC processes more efficient.

5. Advanced Error Detection: AI algorithms can identify anomalies in results, ensuring data accuracy. This is particularly critical in industries like pharmaceuticals, where precision is paramount.

6. Integration with IoT: AI-powered GC systems connected to IoT devices allow remote monitoring and control. Users can track performance metrics and adjust processes in real time, even from distant locations.

Market Segments

By Instruments

• Systems

• Autosamplers

• Fraction Collectors

• Detectors

By Accessories and Consumables

•Columns Accessories

• Flow Management Accessories

• Consumables & Accessories

• Fittings and Tubing

• Pressure Regulators

• Gas Generators

• Other

By Reagents

• Analytical Reagents

• Bioprocess Reagents

By End User

• Pharmaceutical

• Oil and Gas

• Food and Beverage

• Agriculture

• Cosmetics Industry

• Environmental Agencies

• Others

Buy This Premium Research Report: https://marketresearch.biz/purchase-report/?report_id=48318

Market Dynamics

Driver: The gas chromatography market is primarily driven by its extensive application across various industries, including environmental analysis, pharmaceuticals, and food safety. In environmental monitoring, gas chromatography is essential for detecting pollutants and ensuring compliance with environmental regulations. In the pharmaceutical sector, it is utilized for quality control and the analysis of complex compounds. Additionally, the food industry relies on gas chromatography to identify contaminants and ensure product safety. The versatility and precision of gas chromatography in analyzing volatile and semi-volatile compounds contribute significantly to its widespread adoption and market growth.

Trend: A notable trend in the gas chromatography market is the integration of high-resolution mass spectrometry (HRMS) to enhance analytical capabilities. This combination allows for more precise identification and quantification of complex mixtures, improving detection limits and expanding the range of analytes that can be studied. The adoption of HRMS in gas chromatography is particularly beneficial in fields like human exposomics, where comprehensive analysis of environmental and biological samples is required. This trend reflects a broader movement towards more advanced and sensitive analytical techniques in laboratory settings.

Restraint: Despite its advantages, the gas chromatography market faces challenges such as the high cost of equipment and the need for skilled personnel to operate complex instruments. These factors can limit adoption, especially in small laboratories or in regions with limited resources. Additionally, the emergence of alternative analytical techniques, such as liquid chromatography and supercritical fluid chromatography, which offer certain benefits over traditional gas chromatography, may pose competitive challenges. These alternatives can provide enhanced analysis of very polar and ionic compounds, which are challenging for gas chromatography.

Opportunity: The increasing focus on environmental sustainability and the monitoring of pollutants presents significant opportunities for the gas chromatography market. As regulations become more stringent, there is a growing demand for precise and reliable analytical methods to detect and quantify environmental contaminants. Gas chromatography, with its ability to analyze volatile organic compounds, is well-positioned to meet this need. Furthermore, advancements in sample preparation and separation methods are enhancing the capability of gas chromatography to analyze very polar and ionic compounds, thereby expanding its application scope.

Regional Analysis

North America leads the global gas chromatography market, accounting for 40% of the share. This dominance is driven by widespread applications in pharmaceuticals, environmental testing, and petrochemicals. The U.S. plays a pivotal role, supported by significant R&D investments and stringent regulatory frameworks for food, drug, and environmental safety.

Europe remains a key contributor, driven by industrial applications and strict regulatory standards. Germany, the UK, and France leverage advanced technologies in chemical, pharmaceutical, and environmental sectors, with strong adoption in research and quality control laboratories.

Asia Pacific is the fastest-growing region, fueled by industrial expansion and rising research activities in China, Japan, and India. The growth is bolstered by government initiatives to enhance healthcare and enforce environmental regulations. Emerging markets in the Middle East & Africa are driven by the oil and gas sector, while Latin America, led by Brazil and Mexico, sees moderate growth from expanding pharmaceutical and food industries.

Competitive Landscape:

The global gas chromatography market is poised for steady growth in 2024, driven by advancements in pharmaceutical research, environmental analysis, and industrial applications. Market leaders are focusing on innovation and strategic expansion to enhance their competitive edge.

Thermo Fisher Scientific maintains dominance with a comprehensive portfolio of high-performance GC instruments and consumables, emphasizing innovation and customer-centric solutions. Danaher Corporation leverages subsidiaries like Phenomenex and Agilent Technologies to offer advanced GC solutions across diverse industries, supported by strong R&D and acquisitions.

Restek Corporation focuses on reliability and niche customization, while Siemens excels in industrial applications with advanced process analytics. Edinburgh Instruments and SRI Instruments cater to academia with compact, cost-effective GC systems.

Agilent Technologies drives leadership with next-generation GC technologies and robust customer support. Merck KGaA (MilliporeSigma) and Phenomenex excel in advanced GC columns, while PerkinElmer integrates efficiency and accuracy into health and environmental solutions. Emerging players like Falcon.io and Trajan Scientific enhance market diversity through innovation.

Top Key Players

• Thermo Fisher Scientific

• Danaher.

• Restek Corporation

• Siemens

• Edinburgh Instruments

• SRI Instruments

• Agilent Technologies Inc.

• Regis Technologies Inc.

• GL Sciences Inc.

• PerkinElmer Inc.

• Merck KGaA

• Phenomenex

• Falcon.io ApS

• Trajan Scientific and Medical.

• Virtusa Corp

• General Electric Company

• LECO Corporation

Emerging Trends in Gas Chromatography

Gas chromatography (GC) is evolving with several notable trends enhancing its capabilities. One significant development is the advancement of comprehensive two-dimensional gas chromatography (GC×GC). This technique improves the separation of complex mixtures by utilizing two columns with different properties, allowing for more detailed analysis in fields like petrochemicals and environmental science.

Another trend is the integration of gas chromatography with mass spectrometry (GC-MS) in metabolomics. This combination is ideal for identifying and quantifying small molecules, aiding in the study of metabolites in biological samples. Such applications are crucial in medical research and diagnostics.

Additionally, advancements in pyrolysis-GC technology, including laser pyrolysis and non-discriminating pyrolysis, have expanded its applications. These developments enhance the analysis of polymeric materials, making the process simpler and more reliable.

Use Cases of Gas Chromatography

Gas chromatography is widely used across various sectors due to its precision in separating and analyzing compounds. In environmental analysis, GC is employed to detect pollutants in air and water, ensuring compliance with safety standards. For instance, it can measure volatile organic compounds (VOCs) at concentrations as low as parts per billion, crucial for monitoring air quality.

In the pharmaceutical industry, GC is utilized for quality control, analyzing the purity of drugs. It can detect impurities at levels below 0.1%, ensuring medication safety. In food safety, GC identifies contaminants like pesticide residues. For example, it can detect pesticide levels in fruits and vegetables down to 0.01 mg/kg, helping to enforce regulatory standards.

Moreover, GC-MS has been applied in medical diagnostics, such as analyzing urine samples to detect volatile organic compounds associated with diseases like prostate cancer. In a study, this method achieved a sensitivity of 93.1% and specificity of 95.9% in distinguishing cancer patients from controls.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release