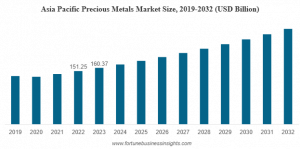

Precious Metals Market Size, Share, Trends | Industry Projected to Reach USD 501.09 Billion by 2032 at a 5.6% CAGR

Key companies covered in precious metals market report are Newmont Corporation, Barrick Gold Corporation, AngloGold Ashanti Limited, and others.

Precious metals have been a cornerstone of global economies for centuries, serving as a store of value, an investment hedge, and a key component in various industries. Gold, silver, platinum, and palladium are the most prominent precious metals, each with unique applications and market dynamics. This article explores the current trends, opportunities, and future outlook of the global precious metals market.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐃𝐅: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/precious-metals-market-105747

➡️ Report Scope:

Market Size Value in 2024: $ 323.71 Bn

Market Size Value in 2032: $ 501.09 Bn

Growth Rate: CAGR of 5.6% (2024-2032)

Base Year: 2023

Historical Data: 2019-2022

Years Considered for the Study: 2019-2032

No. of Report Pages: 230

➡️ Precious Metals Market Types and Applications

Gold

• Investment & Reserve Asset: Central banks and investors consider gold a safe-haven asset.

• Jewelry: The largest consumer of gold, particularly in countries like India and China.

• Technology: Used in electronics due to its conductivity and resistance to corrosion.

Silver

• Industrial Applications: Silver is widely used in solar panels, electrical contacts, and medical devices.

• Jewelry & Silverware: A popular choice for ornaments and household items.

• Investment: Silver coins and bullion serve as an investment hedge.

Platinum

• Automotive Sector: Used in catalytic converters to reduce emissions.

• Jewelry: Gaining popularity due to its durability and rarity.

• Medical & Electronics: Platinum is used in cancer treatments and high-tech equipment.

Palladium

• Automotive Industry: A key component in catalytic converters for gasoline engines.

• Electronics: Used in multilayer ceramic capacitors (MLCCs) and electrical contacts.

• Investment: Increasingly seen as an alternative to gold and platinum.

➡️ Market Trends

1. Investment Demand

Gold and silver continue to be popular investment choices, particularly during economic uncertainties. Central banks, institutional investors, and retail buyers drive demand for bullion, coins, and exchange-traded funds (ETFs). The increasing popularity of digital gold and blockchain-based precious metal trading platforms is also influencing investment trends.

2. Industrial Applications

While gold is predominantly used for investment and jewelry, silver, platinum, and palladium have significant industrial applications. Silver is essential in solar panels, electronics, and medical devices, whereas platinum and palladium are crucial in catalytic converters for automotive emissions control. The push toward green technologies and renewable energy sources is expected to bolster demand for silver and platinum in the coming years.

3. Supply Dynamics

Mining remains the primary source of precious metals, but secondary sources such as recycling are gaining importance. Stricter environmental regulations and declining ore grades are challenging mining operations, leading to increased reliance on recycled materials. Additionally, geopolitical tensions and resource nationalism in major mining regions can disrupt supply chains.

4. Geopolitical and Economic Influences

Global economic conditions, inflation, interest rates, and currency fluctuations significantly impact precious metal prices. For instance, gold prices typically rise during economic downturns as investors seek safe-haven assets. Similarly, trade policies, sanctions, and conflicts can affect mining operations and metal supply.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐒𝐮𝐦𝐦𝐚𝐫𝐲 𝐨𝐟 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐓𝐎𝐂: https://www.fortunebusinessinsights.com/precious-metals-market-105747

➡️LIST OF KEY COMPANIES PROFILED:

• Newmont Corporation (U.S.)

• Barrick Gold Corporation (Canada)

• AngloGold Ashanti Limited (South Africa)

• Kinross Gold Corporation (Canada)

• Newcrest Mining Limited (Australia)

• Gold Fields Limited (South Africa)

• Freeport-McMoRan (U.S.)

• Wheaton Precious Metals (Canada)

• Anglo American Platinum Limited (South Africa)

• Impala Platinum Holdings Limited (South Africa)

➡️ Key Industry Developments

The precious metals market is witnessing significant developments, with gold prices reaching record highs above $3,000 per ounce. This surge has led to increased selling of old jewelry in Asia and the Middle East, potentially impacting imports and market dynamics. Analysts predict further gains for gold in 2025, fueled by geopolitical uncertainties and central bank demand. Meanwhile, silver remains undervalued despite strong industrial and investment interest, with a persistent supply deficit expected to support higher prices. The gold-to-silver ratio exceeding 90:1 suggests potential upside for silver investors in the near term.

Platinum and palladium markets remain volatile, with supply adjustments stabilizing price trends. Copper, a key industrial metal, is expected to surpass $12,000 per tonne due to global demand growth and potential U.S. tariffs. The European Commission has also announced 47 strategic projects to boost domestic production of 14 critical metals essential for energy transition and security, reducing reliance on external sources.

➡️ Challenges in the Precious Metals Market

• Price Volatility: Precious metal prices are highly volatile, influenced by macroeconomic factors, speculative trading, and geopolitical events.

• Environmental and Social Issues: Mining activities contribute to environmental degradation and often raise concerns about labor practices and community displacement.

• Regulatory and Policy Changes: Governments and international bodies impose regulations on mining, trade, and investment in precious metals, impacting market dynamics.

The precious metals market is expected to experience steady growth, driven by investment demand, technological innovations, and industrial applications. The transition to a low-carbon economy, expansion of electric vehicles, and advancements in digital assets will create new opportunities for precious metals. However, challenges such as regulatory constraints, environmental concerns, and market volatility must be addressed to ensure sustainable growth.

Precious metals remain integral to both economic stability and industrial progress. Investors, businesses, and policymakers must navigate the evolving market landscape with informed strategies to maximize opportunities while mitigating risks. As global trends continue to shape supply and demand, the precious metals market will play a crucial role in the future of finance, technology, and sustainability.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧: https://www.fortunebusinessinsights.com/enquiry/customization/precious-metals-market-105747

➡️Read Related Insights:

Boxboard Packaging Market: https://www.fortunebusinessinsights.com/boxboard-packaging-market-109352

Lithium Market: https://www.fortunebusinessinsights.com/lithium-market-104052

Stainless Steel Market: https://www.fortunebusinessinsights.com/stainless-steel-market-106481

Soda Ash Market: https://www.fortunebusinessinsights.com/soda-ash-market-110681

Polyvinyl Chloride (PVC) Market: https://www.fortunebusinessinsights.com/polyvinyl-chloride-pvc-market-109398

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release