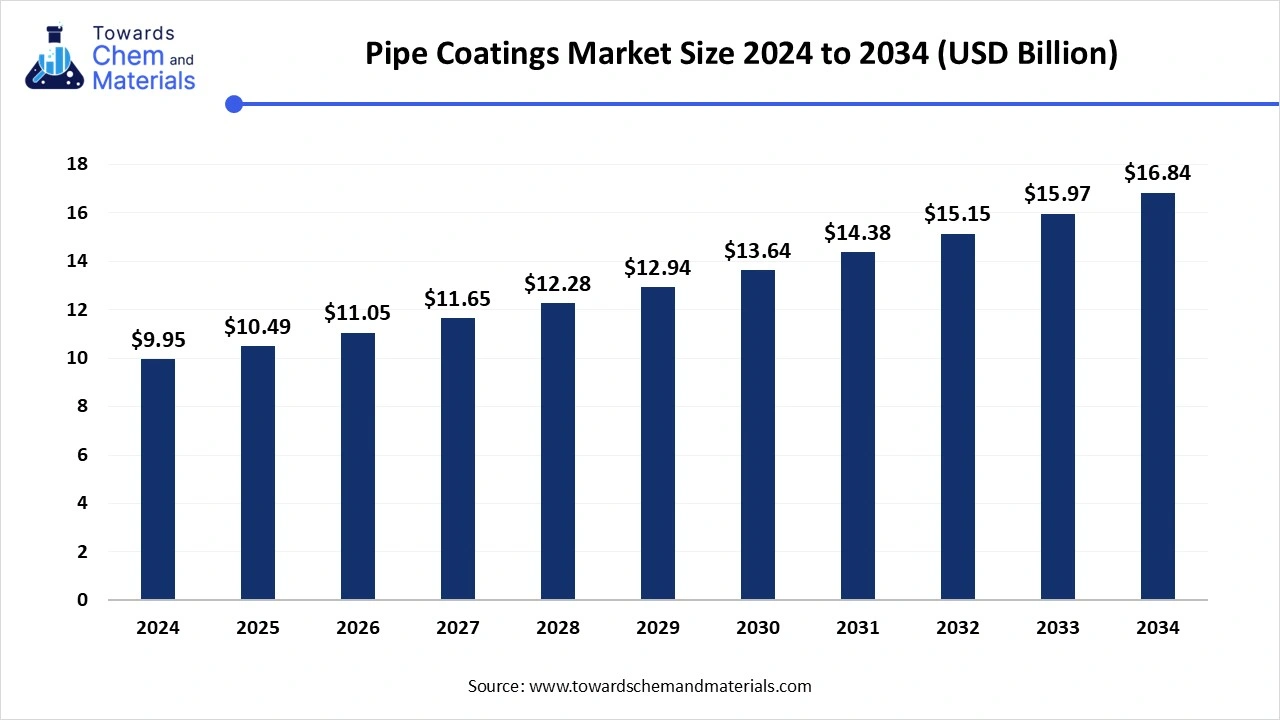

Pipe Coatings Market Size to Reach USD 16.84 Billion by 2034, says Towards chem and Materials Consultants

According to Towards chem and Materials Consultants, the global pipe coatings market size is calculated at USD 10.49 billion in 2025 and is expected to reach around USD 16.84 billion by 2034, growing at a CAGR of 5.40% for the forecasted period.

/EIN News/ -- Ottawa, April 23, 2025 (GLOBE NEWSWIRE) -- The global pipe coatings market size was valued at USD 9.95 billion in 2024 and is predicted to hit around USD 16.84 billion by 2034, a study published by Towards chem and Materials a sister firm of Precedence Research. The pipe coating market has emerged as vital sector, providing advanced protective solutions to enhance pipeline performance and lifespan. As industrial activities and urban infrastructure expand worldwide, the relevance of durable pipe coatings continue to intensify.

Get All the Details in Our Solutions – Download Brochure: https://www.towardschemandmaterials.com/download-brochure/1023

Overview Market

Pipe coatings play a critical role in protecting pipelines from corrosion, physical damage, and chemical exposure, ensuring the longevity and efficiency of oil, gas, water, and wastewater infrastructure. As global energy demands surge and water management becomes more crucial, the pipeline coating industry is experiencing substantial growth. These coatings not only serve as protective barriers but also improve the flow efficiency of transported materials by minimizing friction. The market has expanded beyond convectional anti-corrosion solutions to include advanced coating technologies such as fusion-bonded epoxy, thermoplastic polymer coatings, and liquid-applied systems.

These innovations have emerged due to rising concerns about pipeline integrity and environmental safety, especially in regions experiencing extreme climate conditions or undergoing aggressive industrial development. Increasing investments in pipeline infrastructure projects, especially across North America, the Middle East, and Asia-pacific, are also acting as significant growth enablers. Moreover, stricter regulations regarding pipeline maintenance and leakage prevention are encouraging stakeholders to opt for high-performance and sustainable coating solutions.

Pipe Coatings Market Key Takeaways

- The U.S. pipe coatings market size was estimated at USD 2.10 billion in 2024 and is projected to grow at a CAGR of 6.14% from 2025 to 2034.

- The North America dominated the pipe Coatings market with the largest revenue share of 30.14% in 2024.

- The Asia-Pacific has held revenue share of around 27.25% in 2024.

- By type, the Thermoplastic polymer coatings type dominated the market with the highest revenue share of 34.19% in 2024.

- By type, the fusion bonding epoxy segment is expected to grow at a exponential CAGR over the forecast period

- By form, the powder segment led the market with the largest revenue share of 79.45% in 2024.

- By form, the liquid coating segment is expected to witness at a significant CAGR during the forecast period

- By application, the oil and gas segment accounted for the largest revenue share of 35.11% in 2024

- By application, the water and wastewater segment is expected to witness at a significant CAGR during the forecast period.

You can place an order or ask any questions, please feel free to contact at sales@towardschemandmaterials.com| +1 804 441 9344

Pipe Coatings Market key Trends

- Sustainability and eco-friendly coatings: There is a growing shift towards environmentally friendly, solvent-free coatings and products with low volatile organic compounds (VOCs). Regulatory pressures and climate goals are pushing manufacturers to innovate and develop green alternatives.

- Fusion-bonded Epoxy: Fusion-bonded epoxy (FBE) coatings are seeing rising adoption due to their superior corrosion resistance, thermal stability, and quick curing time. Especially for oil and gas pipelines, are becoming the go-to solution.

- Digital monitoring integration: Smart pipelines are on the rise, with integrated monitoring systems. This trend is indirectly affecting coating materials as the coatings need to be compatible with embedded sensors and inspection tools.

- Growing applications: Growing applications in pipeline and infrastructure modernization, the demand for pipeline coatings in the water and wastewater sector is growing faster than expected, especially in Asia-pacific

-

Multilayer coatings: Multi-functional coating systems that offer both corrosion and mechanical protection are gaining popularity. These combine various material like epoxy primers, polyethylene layers, and topcoats for enhanced durability.

Limitations and Challenges in Pipe Coatings Market

- High initial investment: The application of advanced coatings systems involves high capital expenditure for equipment, skilled labor, and quality materials. This acts as a barrier, particularly for smaller contractors or government funded projects with tight budgets.

- Volatile raw material prices: The fluctuating prices of raw materials like epoxy resins, polyurethanes, and polymers directly impact the profit margins of manufacturers and increase the overall cost for end-users.

- Stringent regulatory compliance: Meeting international quality standards and environmental regulations requires continuous R&D and documentation, increasing operational complexity and compliance costs.

- Environmental hazards: Some coatings types, especially solvent based, release harmful VOCs, posing risks to workers and the environment if not applied under controlled conditions.

-

Limited skilled workforce: Proper application of pipeline coatings demands specialized knowledge. A shortage of skilled professionals, especially in emerging economies, hinders market scalability.

Immediate Delivery Available | Buy This Premium Report @ https://www.towardschemandmaterials.com/price/1023

Different Types of Pipeline Coating

They are selected based on the coating material, pipeline design, internal coating and external coating forces, connectivity, the development of processes and durability, impermeability, and the frequency of maintenance.

Following are the main types of pipelining coating:

-

Pipeline For Waste Water

It is helpful for wastewater and transportation, which are made mainly of water with a slight amount of solid waste. Depending on the pressure in the pipes and other factors, it can be made of concrete pipes, PVC, cast iron, or clay. Pipe diameters determined by the materials used and the pressure inside the tube.

-

Pipeline For Petroleum Oil

It is made of steel that is treated with the outer coating of the Catholic and protection to prevent external corrosion. Welding oil pipeline connection uses. The oil pipeline is divided into two types: crude oil pipeline, which transported crude oil to refineries, and pipeline product, which transported goods such as gasoline to the market.

-

Liquid Epoxy

The liquid epoxy pipeline coating process is very easy. The chemical reaction between the epoxy resin and hardener or catalyst liquid epoxy produces. A chemical reaction transforms the two into the hard layer when you’re sided by side. You can apply epoxy with a brush, roller, or spray after mixing.

The use of liquid epoxy usually in this area welds size cover, fittings, valves, as well as for the rehabilitation field of short parts of the tubes. He also works as an additional layer of protection at the front of the soil into the air, where underground plumbing meets the atmosphere.

-

Epoxy Coal Tar

Coal tar epoxy (CTE) is a liquid epoxy that has had some of the mineral fillers replaced with semi-liquid coal tar pitch. CTE cures by combining resin and hardener (parts A and B) to generate a thermoset covering, which is typical of all chemically epoxy resins. The thickness of coal tar epoxy coatings, like liquid epoxy coatings, determines by the particle content and the number of applications applies to the steel.

CTE applications for pipeline work are typically between 15 and 35 mils thick. The cure period of coal tar epoxy is relatively long. It will take five to seven days to properly cure at ambient temperatures (for example, 75 F). Force curing at 150 ° F might cut cure time to 8 hours.

-

Polyolefin Three-Layer Coatings

A primer (FBE or liquid epoxy), an adhesive intermediate layer (copolymer), and a topcoat make up a three-layer coating (polyolefin). This type of coating has normally uses in pipelines with high electrical resistance since the 1980s. The first coat for three-layer coatings, like FBE coatings, involves preheating the pipes.

The FBE and copolymer layers spray on, following by a final topcoat (the tie layer can alternatively apply through side extrusion). Polyethene frequently uses as a topcoat, while polypropylene is preferable if the pipeline can expose to high service temperatures.

-

Galvanizing

One of the most common types of steel pipe coating is galvanizing or galvanizing several. Even if the metal itself has several great corrosion resistance and tensile strength capabilities, it still requires a zinc coating for a better finish. Galvanizing can complete in a variety of ways, depending on the method’s availability.

The most often used method, however, is hot-dip or batch dip galvanizing, which involves immersing a steel pipe in molten zinc. A metallurgical reaction between the steel pipe alloy and the zinc produces a surface finish on the metal that delivers a corrosion-resistant quality never seen previously on the pipe.

Another benefit of galvanizing is the cost savings. Numerous firms and businesses have chosen this method. Because it is easy and does not require any secondary operations or post-processing.

Product Expansion & Technological Advancements: Market’s Largest Potential

The pipe coatings market is gaining traction, driven by its multifunctional, high-performance systems. Recently there has been noticed an upsurge in the demand of pipes or pipelines for sustainable and smart coatings. A shift towards investment and R&D focusing on increasing the durability, adaptability, and environmental compatibility of coatings. Technological improvements, environmental regulations, and expanding infrastructure across the globe are propelling demand for better, longer-lasting, and greener coatings. From traditional epoxy layers to intelligent self-healing coatings, the market is transforming how pipelines are protected, ensuring reliability and efficiency across industrial landscape. As emerging economies seek to modernize their pipeline systems, the global pipe coatings industry stands at the forefront of this transformation.

“A recent survey stated that both DCVG and ACGV surveys are employed to assess the condition of coatings on buried pipelines and to detect coating defects, commonly referred to as holidays.”

Additionally, the pipeline coating market is undergoing transformative development driven by innovation, infrastructure expansion and increasing regulatory focus on pipeline safety. In recent years, several noteworthy advancements have been noticed over the year. Major players are forming strategic alliances to expand their geographical footprint and improve product offerings. This includes partnerships between raw materials suppliers, coating manufacturers, and pipeline installation firms. Beyond pipeline installations, there is an increasing demand for coating solutions tailored for refurbishment and retrofitting of aging infrastructure, particularly in North America and Europe.

The introduction of robotic and automated systems for coating pipe, especially in inaccessible hazardous areas, has improved consistency, efficiency, and safety. New digital tools are being integrated to monitor coatings thickness, drying times, and environmental conditions in real-time during application, ensuring long-lasting performance.

Regional Analysis:

North America to Sustain as a Leader: What to Expect till 2030

North America continues to dominate the global pipe coatings market, underpinned by its developed oil and gas industry, advanced pipeline infrastructure, and heightened environmental regulations. The United States, Canada, and Mexico are at the forefront of this regional leadership, driven by extensive pipeline network with vast miles of underground pipelines, particularly in the U.S. and Canada, the region requires robust, high-performance coatings to combat corrosion, abrasion, and environmental stress.

American companies lead the way in developing advanced coating materials such as fusion bonded epoxy and multi- layer polyolefin coatings, ensuring superior durability and operational efficiency. Ongoing repair and modernization of aging pipeline infrastructure further fuel the demand for protective coatings, particularly in the oil and water transport sectors.

North American Countries & Their Contribution to Pipe Coatings Market

- United States: Largest pipeline network, massive investment in shale gas, and rapid infrastructure upgrades.

- Canada: High export-oriented oil production and harsh climate conditions increasing the demand for thermal-insulating coatings.

This regional durability is shaping a competitive and highly dynamic global market for pipe coatings, offering diverse opportunities for key players to innovate, collaborate and expand.

How is Asia Pacific Expanding in the Pipe Coatings Market?

Asia-pacific is witnessing the fastest growth in the pipe coatings market, fueled by rapid industrialization, urban development, and large-scale energy projects. The region’s escalating energy consumption is driving the development of new oil and gas infrastructure, requiring high-performance proactive coatings. Many government initiatives towards strategic energy and water security policies, such as India’s smart cities mission and China’s belt and road initiative, are indirectly bolstering demand for corrosion- resistance coatings. The presence of low-cost manufacturing hubs in countries like China and India promotes the production of pipe coatings at competitive rates, encouraging local adoption and experts.

Major factors driving to growth in Asia-pacific

- Expanding energy and utility infrastructure

- Increasing government focus on sustainable development

- Growth of urban construction and public utilities

- Rising industrial manufacturing demands

- Leading investments in urban utilities and industrial pipelines

- Growing demand for pipeline infrastructure in both energy and municipal sectors.

- Focus on efficient, durable infrastructure amidst ageing water pipeline concerns

- Technological prowess in smart coatings and industrial coatings.

- Expanding oil, gas, and water projects across islands to ensure connectivity.

This region is rapidly catching up, supported by massive infrastructural investments and expanding industrial activities.

Segment Outlook

By Type

Thermoplastic polymer coatings segment dominated the market in 2024, the growth of the segment is due to the flexibility, durability, and excellent barrier properties. The demand of this market is growing due to materials such as polyethylene, polypropylene, and polyurethane which promotes cost-effective and ecofriendly approach. Also, an increasing adoption of technological advancements and use of high-tech AI tools have surged the segment growth in the market. The key contributing factor in heaving growth of the sector is coating which protects the pipelines from harsh environment like moisture and chemicals.

On the other hand, Fusion bonded Epoxy coatings are anticipated to grow in pipe coating market, due to exceptional adhesion, corrosion resistance, and longevity. Their thermosetting nature makes them ideal for extreme environments and underground installations. Moreover, the cumulative high-temperature, application from industries like powder plant, chemical processing and geothermal energy project is contributing towards growth of the market.

By Form

The powder segment dominated the market in 2024, the growth of the segment is due to their eco-friendly application, reduced waste, and ease of curing. They are particularly prevalent in large-scale projects.

On the other hand, liquid segment is anticipated to grow in pipe coating market, due to emerging finding applications where complex geometries or uneven surfaces require more adaptable solutions. Their potential for fine-tuned customization is accelerating their growth.

By Application

The oil and gas sector segment dominated the market in 2024, the growth of the segment is due to protective coatings to combat corrosion and mechanical wear in high pressure and high-temperature environments.

Furthermore, Water and wastewater management segment is anticipated to grow in pipe coating market, due to urban expansion and increasing awareness about clean water access, this segment is rapidly growing. Pipe coatings in this domain help prevent microbial growth, mineral scaling, and leakage.

Join now to access the latest chemicals and materials in industry segmentation insights with our Annual Membership: https://www.towardschemandmaterials.com/get-an-annual-membership

Browse More Insights of Towards Chem and Materials:

- Coating Resins Market : The global coating resins market size was valued at USD 59.71 bn in 2024 and is estimated to hit around USD 105.43 bn by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.

- Powder Coatings Market : The global powder coatings market size was valued at USD 17.25 billion in 2024 and is estimated to hit around USD 30.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% during the forecast period 2025 to 2034.

- Concrete Floor Coatings Market: The global concrete floor coatings market size was valued at USD 5.07 billion in 2024 and is expected to reach around USD 8.53 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

- Flat Glass Coatings Market : The global concrete floor coatings market size was reached at USD 3.91 billion in 2024 and is estimated to reach around USD 14.75 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.20% during the forecast period 2025 to 2034.

- Anti-fingerprint Coating Market : The global anti-fingerprint coating market size is calculated at USD 1.54 billion in 2024, grew to USD 1.65 billion in 2025 and is predicted to hit around USD 2.91 billion by 2034, expanding at healthy CAGR of 6.54% between 2025 and 2034.

- Nanocoatings Market : The global nanocoatings market size accounted for USD 16.93 billion in 2024 and is predicted to increase from USD 20.10 billion in 2025 to approximately USD 94.40 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

-

Self-Healing Coatings Market : The global self-healing coatings market size accounted for USD 3.21 billion in 2024 and is predicted to increase from USD 4.12 billion in 2025 to approximately USD 39.16 billion by 2034, expanding at a CAGR of 28.42% from 2025 to 2034.

Pipe Coatings Market Top Key Companies:

- PPG Industries, Inc.

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- Valspar Industrial.

- Axalta Coating Systems, LLC

- WASCO ENERGY GROUP OF COMPANIES

- Arkema Group

- 3M

- SHAWCOR

- Berry Plastics Cpg

- Tenaris

- Winn & Coales (Denso) Ltd

- Aegion Corporation

- Dura-Bond Industries

- Eupec Pipecoatings France

- L.B. Foster Company

- Arabian Pipe Coating Company

- Perma-Pipe

- Jotun

- DuPont.

Recent Development:

- In April 2025, Surya Roshni co ltd has grown to become the largest manufacturer of GI pipes in India and a major exporter of ERW pipes. In addition to steel products, Surya Roshni offers a wide range of lighting solutions, including conventional and LED lighting, as well as consumer durables like fans and home appliance

Segments Covered in The Report

By Type

- Thermoplastic Polymer Coatings

- Fusion Bonded Epoxy Coatings

- Bituminous

- Concrete

- Other Types

By Form

- Liquid

- Powder

- Solvent

By Application

- Oil & Gas

- Water & Wastewater

- Chemical Processing

- Mining

- Agriculture

- Other Applications

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/1023

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chem and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release